Award-winning PDF software

P45 form definition - investopedia

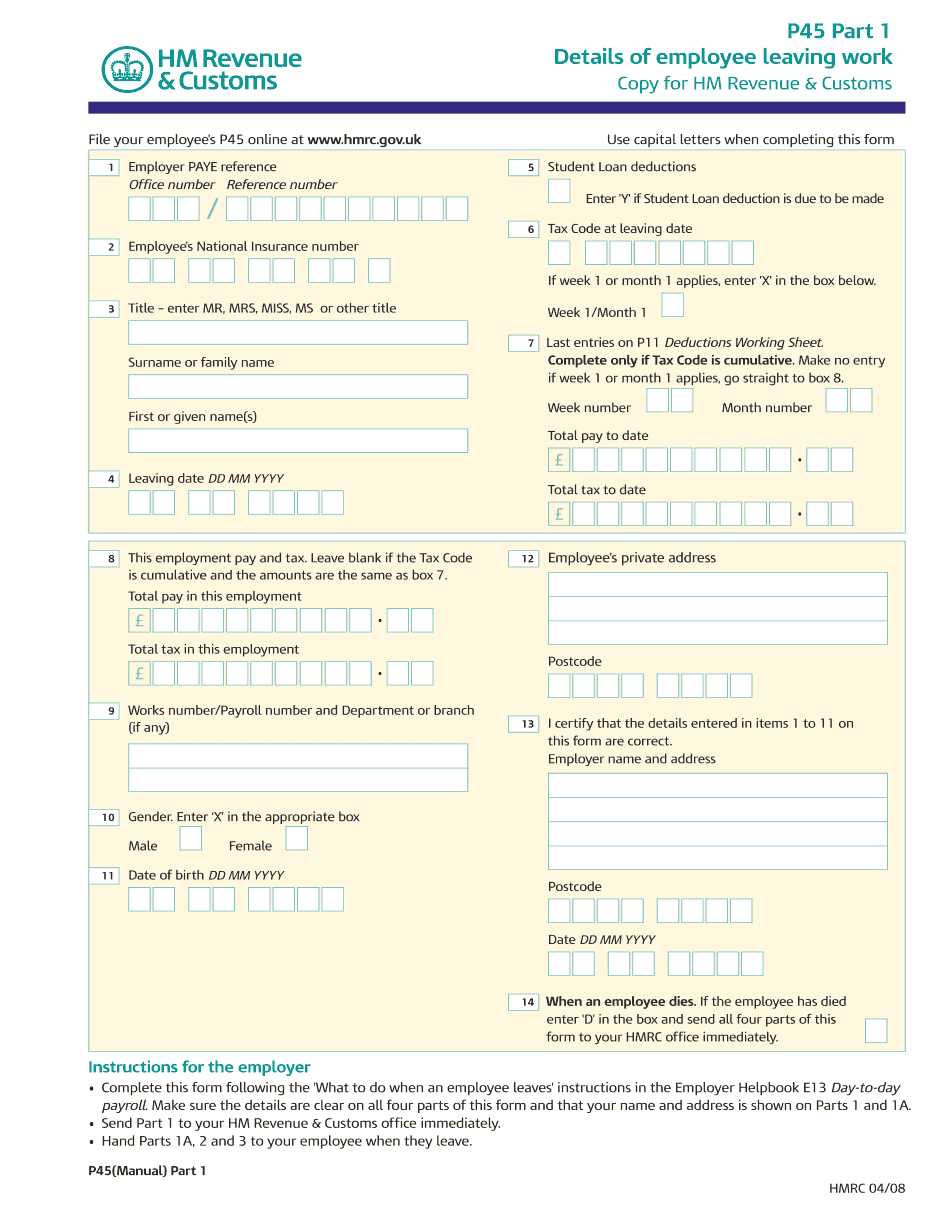

The P45 Form is a requirement to provide receipts, account entries, bank statements and tax returns. All these details are required to be provided, in any detail, to the employee. If a tax or insurance company is not required to provide tax or insurance records or receipts, this may be because you do not make deductions. If you do not provide the required documents the employee could claim you have ignored the information. Therefore, it is important that you ensure that the P45 Form is completed up to the termination of the employment relationship and that the employee acknowledges in this statement their acknowledgement that there have been no changes in their circumstances. 5. Employee P45 Forms: The Employee P45 Form for a UK based employee is also required to: Show the details of the employment contracts and leave stipend (if any) Include a detailed description of leave pay; it must be in the following.

P45 form: what's included and how to get one - nerdwallet

Other deductions you may have made. If you have earned a bonus or pension from your workplace, the form will also show you how much you were given, and how much you were paid in, for the money you earned. To get a copy of your P45, you will need to write to whichever job center you were working for when you left, asking them to give you a copy. However, they must provide you with a copy of your pay, so do not have to prove you worked for that business. How to find out P45 income information (by form AIR, Employer Provided Income, or a separate form): If you are worried about your income and want to check what has been claimed for what (including any bonus or pension) you can download your P45. Fill it in and give it to your employer. Ask them what income were you.

What is a p45 and why is it important?

I had heard this figure was higher and thought “good”, which can be a red flag — we don't want people to be overpaid. However, I didn't have a breakdown of how long it was that you were overpaid, only that time. So all these details were out of my control. Now that we know what “overpaid” and underpaid are, I'm confident we can move forward. Let's start with the overpaid. The Overpaid have worked for 1) longer, and 2) for a firm with more capital. I suspect that a large portion of them are people with many years of experience, that have worked for larger firms, because the money-making capital of many (large) companies is to be found in management and engineering, not sales, marketing, or customer service. You can imagine how easy it is to become overpaid in this industry because companies offer higher salaries than they do to sales.

What is a p45 form in the uk and why does it matter?

You can see an example P45 form on the Pay Rate for a Junior or Young Worker page. If you're looking for a Pay Rate for a Senior (65+) You can now go here. If you have the “Pay Rate” in the P45 form, that is the pay rate you'll get on the job, or job interview (if applicable) or when you go for your interview or on the job. You can also get the details of all the jobs you've worked at from your “Work History”... You can find out more about what is in your P45 here. Pay rate for a Young Worker If you are an unpaid youth worker, you will get a payment when the employer makes a hire from you. In this case you will get your first PAY. This may be for a number of weeks prior to the “Hire from you” date. The first payday after.

What is a p45?

You may need to provide a current W2 or 1099 form to your former employer, so it can show it pays your taxes on the right amount. This list has been updated. How to get them On paper. The Social Security Administration (SSA) You should mail Form W-9 (for all employers) or Form 941-W (for businesses) to your former employer. The state Department of Revenue (FOR) Send a paper letter requesting the payment of unemployment taxes to the Taxpayer Services Department. The IRS The IRS has information on submitting tax returns for other tax periods. Other ways to get them Phone. Most social media, and private and government agencies, can provide records directly in error and on time — with no need for an attorney. Find out how. If you need a lawyer If you have been injured by a former employer and have proof you had the rights and obligations imposed on you by that company and other job-related insurance, you may be.